|

U.S. Pharma Moves to China and India |

|

Outsourcing is one of

the 4 cornerstones of the 08 Crash. 2) the others being the loose money policy

of the Federal Reserve Bank which created the housing bubble by its loan policy to member banks and similar debt bubbles with

credit cards, federal government, and commercial loans. 3) the deregulation of

the financial industry. 4) falling wages when measured by the real CPI whici currently has risen 12%--not the bullshit feds listed 3%. Pharma's new favorite outsourcing spot: China 10/3/08 Tracy Staton, FiercePharma Quality-control fears notwithstanding, China has knocked India off the catbird seat as pharma's favorite

spot for outsourcing. According to a new report from PriceWaterhouse Coopers, China beats every other Asian country as an

investment and contracting destination, followed by India, Korea and Taiwan. The countries all were evaluated by cost, risk,

and market opportunities. And it's not just low-cost production that's luring pharma to Asia, either. The report found that the region

is growing in stature as a source for innovation and discovery.[i] Plus, local markets are burgeoning, giving pharma the potential

for lots of new emerging-market sales. The various countries have different strengths, with China and India the primary drivers of pharma growth in the region. Singapore, on the other hand, is considered more of an R&D specialist, while Korea and Taiwan are emerging as competitors for pharma investment and business. What's contributing the the region's magnetism?

Greater attention to intellectual property protections, for one. Cheaper clinical

trials, of course. And an explosion of growth in certified contract manufacturers. In India, for example, there are more

than 100 FDA-approved pharma plants, the largest number in any country outside the U.S. [i] Sinovac

for example is developing a new bird flu therapy. R&D in china is growing

at about 20% per year since 1999. Hundreds of companies have opened research

centres in |

|

More

bull shit: it isn’t falling profit (for their revenues were down only 2%),

but rather outsourcing that caused Merck to terminate 12% of their work force. The

entire industry is moving as much as possible to They (the globalizers)

promised us the good jobs, and the shitty manufacturing ones would be outsourced. But

now it is the good ones, from accounting to the pharmaceutical and computer industries that are taking flight. Today there was more bull shit reporting. Merck claims that

earnings dropped for the 3rd quarter 28% and was the cause of their cutting their workforce an additional 12% (7,200

jobs). But a reading of the release indicates that though sales fell for some

key drugs, however, overall sales fell only 2%. This is actually a growth given that there is a more than 2%

drop in the overall market due to our current economic depression. Earnings didn’t

fall 28%, rather Merck unloaded some debt that they had carried on their books from restructuring. By doing this their earnings went up, for their taxes went down.

It seems

odd that a company can get rid of so many October 22, 2008 — 9:33am ET , Christe Bruderlin-Nelson |

|

|

||

|

Merck

said today that it will cuts 7,200 jobs--more than 12 percent of its workforce--following

the announcement of a 28 percent drop in Q3 earnings. The job cuts, which will include 6,800 active employees and 400 vacancies,

will be made in all areas of the company. Forty percent of the cuts will be in the In

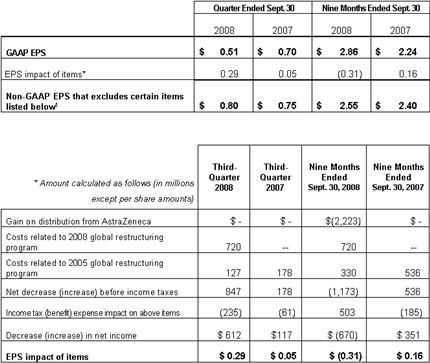

Q3, the company took a multimillion restructuring million charge (about 29 cents a share) and had unimpressive sales. As a

result, net income dropped to $1.08 billion--just 51 cents a share--down from $1.53 billion and 70 cents a share a year ago.

Third-quarter revenue was down 2 percent, partly due to sluggish sales for most of its vaccines, major generic

competition for Fosamax, and a drop in its cholesterol drug sales of about 15 percent to $1.1 billion. Merck did see some

positive movement with its blood pressure, asthma, HIV and diabetes drugs. The

restructuring includes more than just layoffs. In a release, the company said it would: In

addition, Merck said it will consolidate its R&D ops. Basic search operations will be organized to consolidate

work in support of a given therapeutic area into one of four locations. As a result, Merck will close three research sites

in "Our

focus remains on increasing revenue from our new and in-line products, fully funding innovative R&D, investing in growth

opportunities, such as emerging markets, and becoming the most trusted partner in delivering value to our customers. With

the right long-term strategy and our efforts to reshape Merck's business, including today's actions, I am confident we are

building a solid foundation for achieving industry-leading performance in the future," said CEO Richard Clark (photo). Merck expects restructuring costs from $1.6 billion to $2 billion through 2001, but hopes to save between $3.8 billion

and $4.2 billion by 2013. Chart of Drug sales at: http://www.fiercebiotech.com/pages/mercks-q3-2008-drug-sales-results Merck Reports Third-Quarter 2008 Financial Results October 22, 2008 .

|

|||